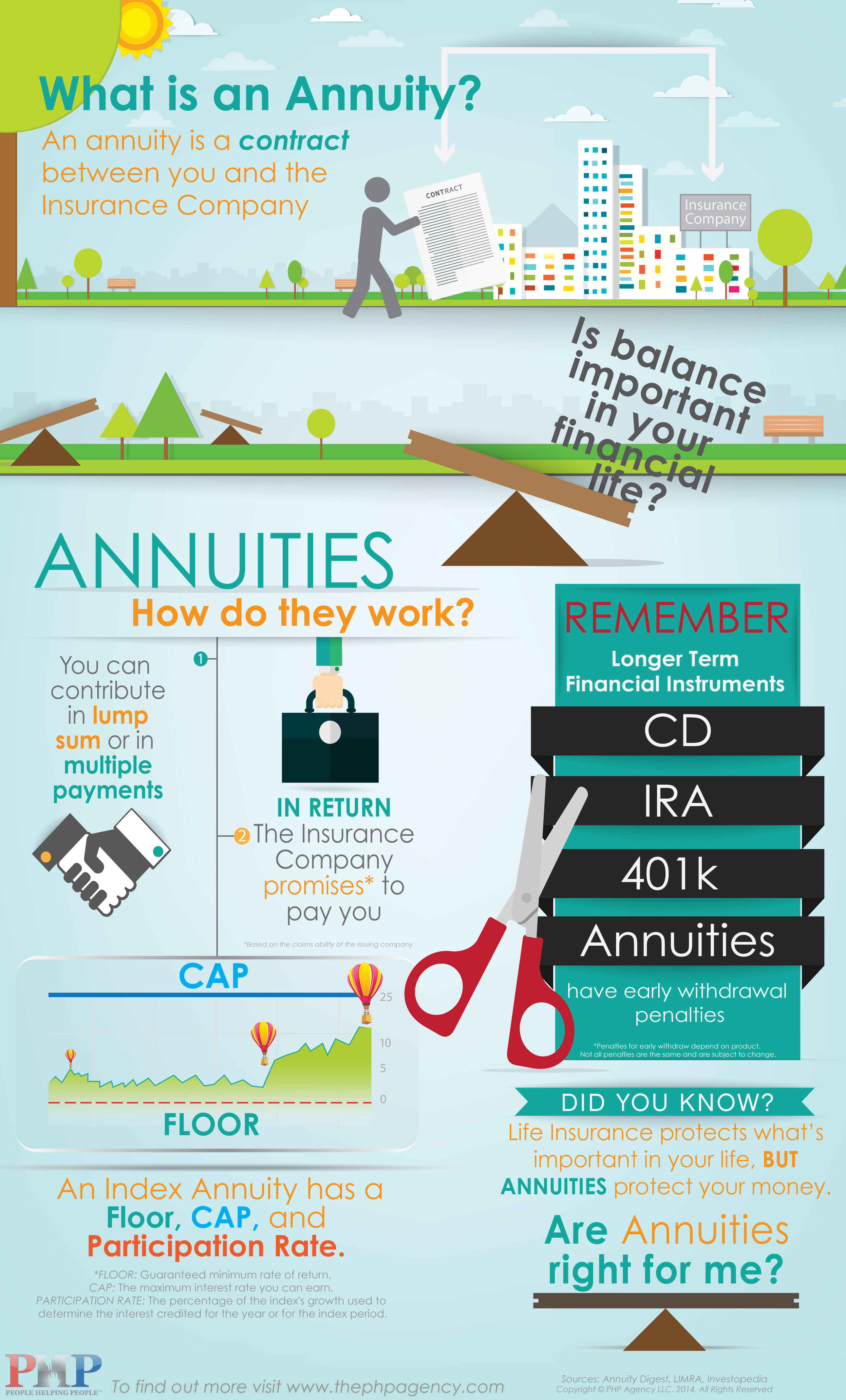

A life annuity is a financial contract, issued by a life insurance company, designed to provide payments to the holder at specified intervals, usually after retirement.

- Guaranteed principal

- Death benefit

- Tax-deferred retirement income

- Structured to provide income for the rest of your life

This is a special class of annuities offered by FSPro that yields returns on your contributions based on a specific equity-based “index,” such as the S&P 500. With an Indexed Annuity there is a guaranteed minimum return, so even if the stock index does poorly, the holder will not lose any part of his investment. Conversely, the yields will be somewhat lower due to caps and fee-related deductions.

FACTS WE HAVE

KEY STEPS IN LIBERATING YOURSELF FROM FINANCIAL GRIEF

- Talk to a Financial Professional

- Explain your needs, wants, and goals

- Manage losses by prioritizing debts

- Prepare for financial surprises

- Live below your means, not within your means

- Don’t just save. Save intelligently so that your savings work for you

ECONOMIC FACTS RELEVANT TO YOU

- 46.7 Million people in the US living in poverty – census.gov

- 62% Americans have less than 1k in savings – Google Consumer Survey

- 63 Million don’t even have a savings account – Google Consumer Survey

- 29 Million Americans remain uninsured today – time.com

The average American household carries $203,163 in financial baggage such as mortgages, balances and student loan debt, according to an analysis in April of last year. What’s more harrowing is that this figure doesn’t account for other debts, such as auto loans and personal loans that further weigh down individuals.

- money.usnews.com / 2014

How can we manage this situation and still worry about planning for financial growth and security?

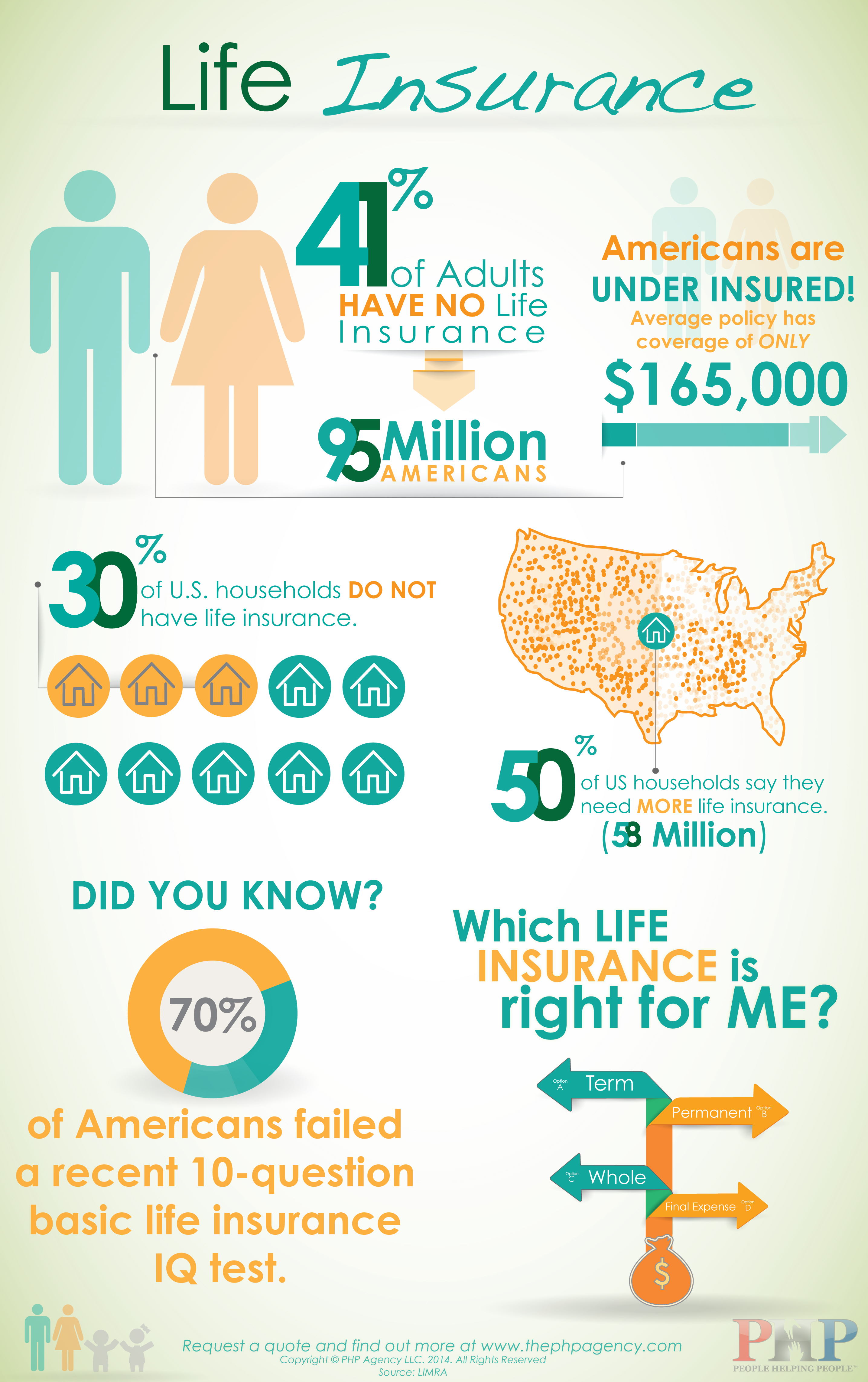

Life Insurance

“Term” is a life insurance policy that provides coverage for a predetermined amount of time. Benefits are gained if the policy owner passes away in a predetermined time frame, typically 10, 15, 20, or 30 years.

- It is the least expensive and simplest of all life insurance policies

- There is no guarantee of renewal when the term ends

- FSPro offers the most inexpensive Term Insurance on the market

Return-of-Premium Term Life Insurance

FSPro also offers a compelling 35-year Term Insurance policy that will return your ENTIRE premium if you outlive the term period of your life insurance.

- Premium returns can start as early as the second year

- Protection if you need it and a return of all your premiums paid if no death occurs

- Up to 17-year durations

Indexed Universal Life Insurance

Indexed Universal Life Insurance is a form of permanent life insurance. It’s an insurance policy where the benefit is assured to be paid upon your death (assuming the policy is kept current). Also, unlike Term Insurance, the policy can accrue a cash value within specified “indexes” (such as the S&P 500 or Nasdaq 100).

- A type of permanent life insurance

- You can choose your “index” based on your risk tolerance

- Cash value has tax-deferred growth

- Can be paired with a Long Term Care rider

No-Medical Exam Life Insurance

This simple, affordable life insurance is designed to cover expenses like medical bills and funeral costs (including plot and mortuary expenses) and can help protect your loved ones from future financial burdens. This provides permanent life insurance coverage with flexibility and long-term growth potential.

- Up to $250K death benefit

- No medical exam or blood work is required

Long Term Care

Maybe we should change the name to long term cost, because it sure is expensive. How long will that 401k or IRA last when the average nursing home (aka prison facility depending on your budget) is an easy $50,000 a year. 100 isn’t just the best score on a test anymore, it’s how long people are living

Debt Settlement

How often do we need money but don’t have it or don’t have enough? So we call our friend Visa, Mastercard, Citi, Amex, and so on and ask our dear friends to lend us some money. They say, “Of course!” Then in tiny print it they declare the interest rate (Tiny print: 27.99%). Then we go to school, and you know how expensive tuition and books are (cartoon picture of a person giving blood) so we get a school loan. Now we make all these friends and want to to go out, but we need a car so we get an auto loan. You go on a few dates and find “the one” so you get married and then it’s time to buy a house so we get a mortgage loan. After the honey moon comes a baby and when you bring it home you find the bill form the doctor in the mail. Life happens and taxes fall behind and next think you know you’re so over your head in debt you can’t see a way out. Most families never become debt free, which leads to stress, sickness, and a lot of sadness. That’s when they need to get a debt reduction plan!